How Do Inflation and Exchange Rates Impact Travel

When planning international travel, the exchange rate between the U.S. dollar and a foreign currency can be just as influential as airfare or hotel prices. Even a small shift in currency value can make a destination significantly more affordable—or unexpectedly expensive—for American travelers. A strong dollar stretches further abroad, lowering the cost of meals, attractions, and accommodations, while a weaker dollar can mean revisiting the travel budget or seeking alternative destinations. In a year like 2025, where economic conditions and global events are influencing currency markets daily, understanding exchange rates is more important than ever for getting the most value from a trip.

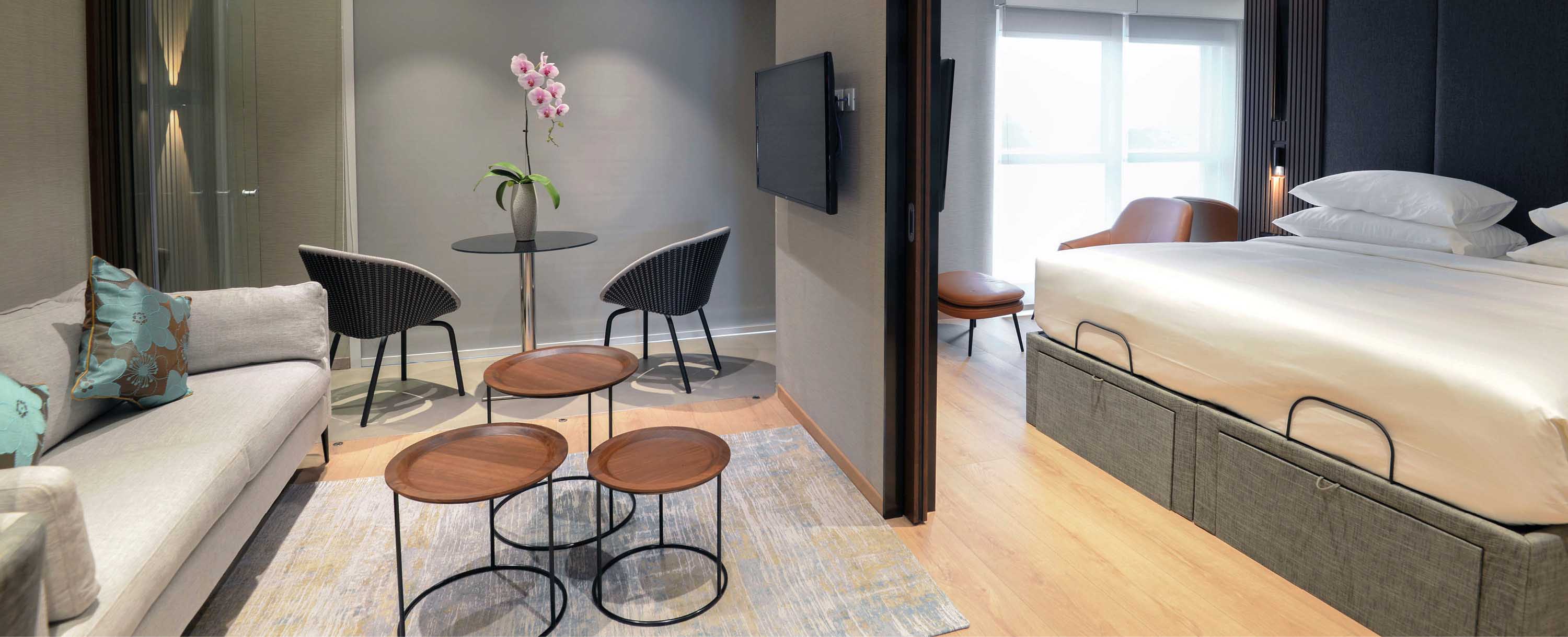

Exchange rates don’t just determine what you pay; they shape how far your travel budget can go once you arrive. A favorable currency conversion can open the door to upgraded hotel stays, additional guided tours, or longer itineraries without increasing overall spending. Conversely, when the dollar loses ground against a local currency, even modest expenses—like coffee, taxi rides, or museum tickets—can add up quickly. Savvy travelers look beyond the headline “top destinations” and consider where their money will work hardest, balancing bucket-list experiences with budget-conscious planning.

The interplay between exchange rates and travel trends means that some destinations become temporary sweet spots for U.S. tourists. Countries with currencies that have weakened against the dollar can offer a level of comfort and luxury that might normally be out of reach. At the same time, nations with strong or appreciating currencies may still attract visitors, but travelers are more likely to trim extras or shorten stays to offset higher day-to-day costs. In this environment, destinations offering a blend of cultural richness, safety, and favorable exchange rates are poised to be the standout choices for 2025.

Hedging Tour and Cruise prices against inflation and exchanges.

One of the simplest ways to protect yourself from unpredictable exchange rate changes is to book a tour or cruise with a predetermined, all-inclusive price. When you lock in your trip cost in U.S. dollars, you shield your budget from the impact of future currency fluctuations. This means that even if the dollar weakens between the time you book and the time you travel, the price you pay remains exactly the same. You can plan excursions, dining, and entertainment without worrying that your daily expenses will suddenly rise because of shifts in the foreign exchange market.

Prepaid packages also bring peace of mind by consolidating most travel expenses into one upfront payment. Tours and cruises often include accommodations, meals, transportation, and guided activities, all priced at the time of booking. Without the constant need to convert currency or monitor spending abroad, travelers can focus on the experience rather than the math. This is especially valuable in destinations with volatile currencies, where exchange rates can move significantly over just a few weeks or months.

For many U.S. travelers in 2025, the appeal is also psychological: a prepaid itinerary means stepping onboard a cruise ship or into a tour group with the satisfaction of knowing the major costs are already taken care of. Instead of reacting to every price tag in a foreign currency, travelers can spend freely within their chosen package and reserve their on-trip budget for personal extras and souvenirs. In times of economic uncertainty, this approach offers both financial stability and the freedom to fully enjoy each destination, no matter what the markets are doing.

Choosing the right financial strategy for your cruises and tours.

In the end, understanding exchange rates is more than a matter of curiosity—it’s a powerful tool for making smarter travel decisions. The value of the U.S. dollar can turn a dream trip into a bargain or push a seemingly affordable getaway into the realm of the impractical. By staying informed about currency trends, travelers can choose destinations where their money goes further, allowing them to enjoy richer experiences without inflating their budgets.

Pairing this awareness with the stability of a prepaid tour or cruise creates a winning strategy. Not only can travelers target destinations where the exchange rate is currently favorable, but they can also shield themselves from any unwelcome changes before departure. Locking in an all-inclusive price in U.S. dollars eliminates the risk of rising daily costs and ensures that the value secured at booking carries through the entire trip.

For 2025, where the dollar’s position varies widely depending on the region, this combination of smart destination selection and price certainty offers the best of both worlds. Travelers can seek out locations where the exchange rate stretches their budget, while also enjoying the reassurance of knowing their core travel expenses are fixed. The result is a trip that delivers both financial confidence and unforgettable experiences—regardless of how the currency markets behave after the booking is made.